Credit Information Bureau India Limited (CIBIL) is known for maintaining a CIBIL Score for each Individual based on the financial transactions made by them in respect of Loans and Credit Cards.We are giving below the Sure Shot Tips to maintain a good CIBIL Score so that you can manage your personal finance in better way.

CIBIL Score is also known as Credit Score.

How CIBIL Score is used by Banks ?

Most of the Banks and Financial Institutions invariably check the CIBIL of the person concerned before sanctioning a Loan or issuing a Credit Card. If CIBIL Score of any person is not “Good” then the Loan or Credit Card Application is instantly rejected.

Categories and Rating

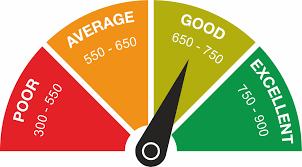

Before, we proceed further, let us see, how CIBIL Score is categorized from “Poor” to “Excellent” categories:

CIBIL RANGE RATING

300-550 POOR

550-650 AVERAGE

650-750 GOOD

750-900 EXCELLENT

Why Loan/Credit Cards are refused by Banks ?

It has been noticed that anyone applies for a Loan or Credit Card and his/her CIBIL Score is less than 750, then there is every possibility that his/her Loan or Credit Card Application shall be rejected by the concerned Bank or Financial Institution.

As more and more persons are now using the Loan and Credit Cards, it becomes really frustrating if your Loan or Credit Card Application is rejected only due the reason that you do not have a Good Credit Score.

In this Blog we will discuss some very simple and basic steps, which should be followed by everyone to maintain a Good or Excellent CIBIL Score.

How to improve your CIBIL Score ?

To ensure that your CIBIL Score always remains in Good or Excellent category, you should keep in mind the following simple things:

- Always pay all your Credit Card Dues and Loan EMIs on time without fail.

- Credit Card Dues should be paid in FULL on the due date

- Do not make unnecessary and repeated enquiries for Credit Cards and Loans during any particular period. This gives an indication that you are desperately looking for some credit card and loan and you are in some debt trap or unemployed.

- If you do not have enough funds for paying the full amount due on your credit card, then it is better to take a Personal Loan first so that you can pay your credit card dues in full. By doing this, you will not only save on the high interest cost on unpaid credit cards, but will also be able to maintain your good credit score.

- Similarly, if you do not have enough funds for paying your Loan EMI on time, it is always better to take a Personal Loan for making the EMI payment on time.

- Personal Loans can be availed very easily if you are able to maintain the Good or Excellent Credit Score.

- It is also necessary that you keep checking your CIBIL Report from time to time to ensure that the data captured by CIBIL Authorities is correct and your CIBIL Score is being shown correctly. If you find any error or mistake in CIBIL Report, the same should be immediately reported to CIBIL Authorities so that you Data is correctly recorded and your CIBIL Score is correctly evaluated.

It is hoped that you will be able to manage your personal finance in a much better way with the help of the above noted-“SURE SHOT TIPS TO MAINTAIN A GOOD CIBIL SCORE”

Also Read:

1 thought on “SURE SHOT TIPS TO MAINTAIN A GOOD CIBIL SCORE?”