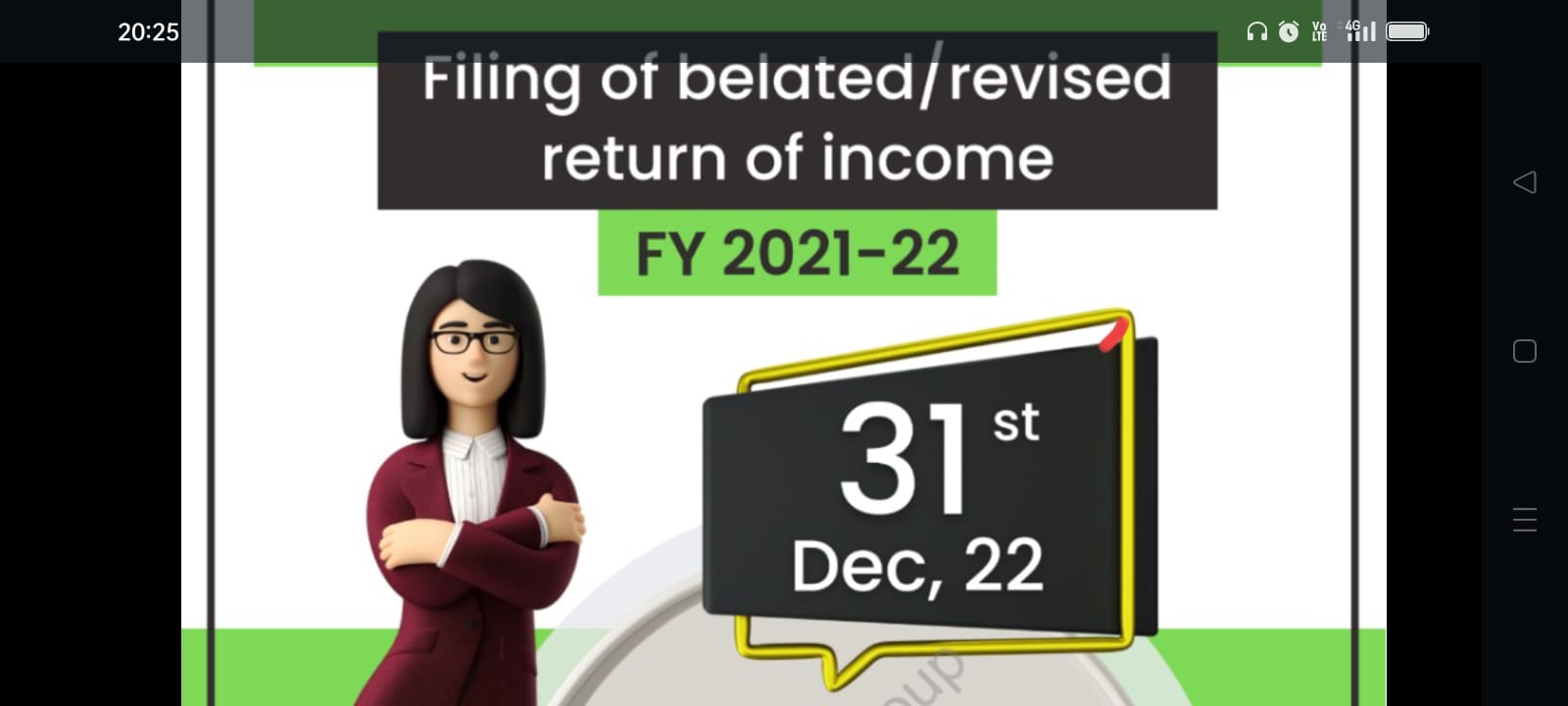

Last date to file ITR for Financial Year 2021-22 is fast approaching. Belated and Revised Income Tax Returns for the Financial Year 2021-22(Assessment Year 2022-23) can be filed by 31st December 2022 for all types of Assesses.

All categories of Assesses including Individuals, HUF, Firms and Body Corporates may please note that only few days are left to file the belated or revised income tax return for the last financial year 2021-22 . After 31st December 2022 they will not be able to file the belated or revised income tax return.

Due Dates for filing the ITR :

Due dates for filing the Income Tax Returns for different categories of Taxpayers are given below:

- Individuals, HUF,AOP & BOI are required to file the ITR by 31st July every year in respect of the previous Financial Year.

- Business entities which are subject to get their Accounts Audited under any law, are required to file the ITR by 31st October every year in respect of the previous Financial Year.

- Business entities which are required to submit Transfer Pricing Report under section 92E of the Income Tax Act, are required to file ITR by 30th November every year in respect of the previous Financial Year.

(1)) If any person listed above, failed to file ITR by the due dates listed above, then the Belated Return under Section 139(4) can be filed by 31st December.

(2) Similarly, a Revised Income Tax Return under section 139(5) of the Income Tax Act, should also be filed by 31st December.

Practically, last date to file Income Tax Return for any Financial Year for all categories of taxpayers is 31st December of the next Financial Year. For example last date to file Income Tax Return for the financial year 2021-22 will be 31st December 2022.

31st December of every year is the date when any taxpayer can file the ITR even if he has missed or failed to file his ITR by the specified due dates for whatever reasons.

What is Financial Year & Assessment Year :

Any period starting with 1st April of any year and ending with 31st March of the next year is known as Financial year. Next financial year is known as Assessment Year. For example for the period starting with 1st April 2021 to 31st March 2022, the financial year will be 2021-22 and the Assessment Year shall be 2022-23.

What happens if you failed to file the ITR by Due Dates:

If you missed to file your ITR by the specified due dates, then you can file the belated ITR by paying penalty prescribed under section 234F of the Income Tax Act, which is Rs.1000 for small taxpayers having taxable income upto Rs.5 Lakh and Rs.5000 for other taxpayers having taxable income more than Rs.5 Lakh.

FAQs :

- Who is exempted from paying the penalty for late filing of ITR ?

Answer : Any person who is voluntarily filing the ITR, is not required to pay any penalty even if he is filing the ITR after the due dates.

- Apart from the penalty, is the taxpayer required to pay any interest or penalty ?

Answer : Under Section 234A of the Income Tax Act, apart from the penalty, you may also be liable for interest/penalty if you have deposited your tax after the due date.

- Who is not required to file the ITR ?

Answer : Any Individual, whose total income does not exceed the basic exemption limit, is not required to file the ITR. Currently this basic exemption limit is Rs.2.5 Lakh

- Whether we should approach a CA mandatorily for filing our ITR ?

Answer : It is not mandatory to approach any CA for filing the ITR. You can file your ITR on your own. However, looking into the complexities of the Income Tax Act and the Nominal Fee charged by the CAs, it is always advisable to approach CAs for filing of the ITRs.

- What are the advantage of filing the ITR with the help of CAs ?

Answer : CAs are qualified professional and experts in taxation laws. It is possible that if you file your ITR yourself without taking help of a CA, then you may miss to claim certain exemption or deduction, which is otherwise available to you under the Income Tax Law. Further, you can also make any mistakes in filing the ITR on your own, which may result in major problem or penalty on a later date. CA not only ensures that there are no mistakes in filing the ITR, he also ensures that you are availing all the deductions and exemptions, which you are entitled under the Income Tax Act.

Also Read: